interest tax shield meaning

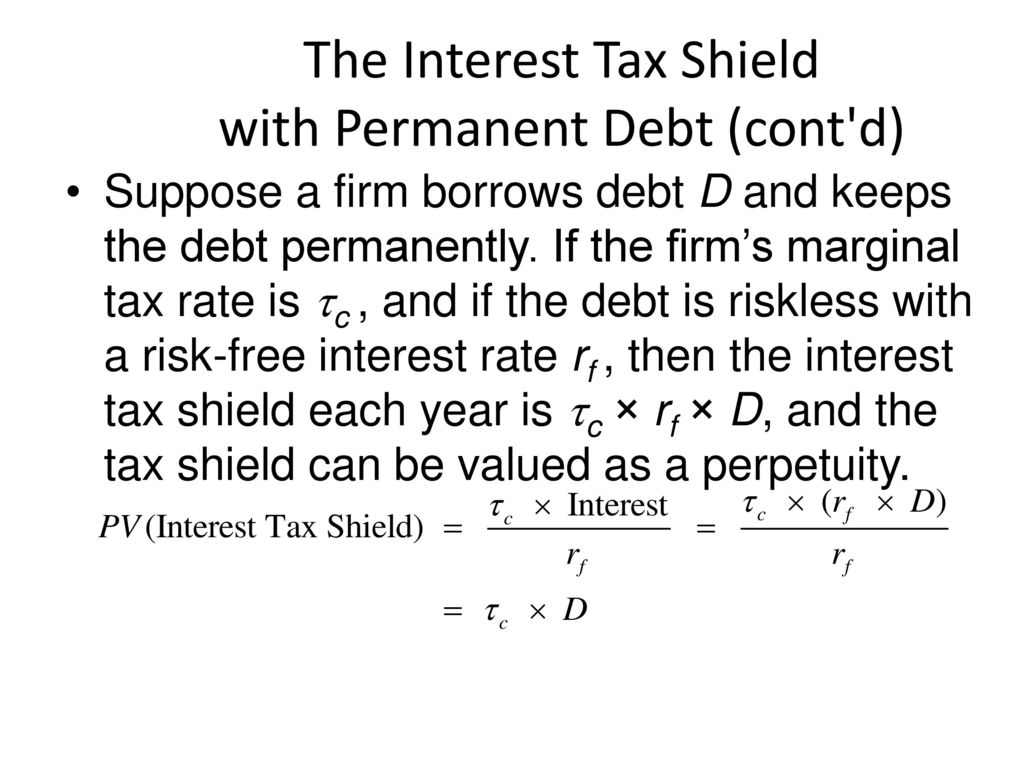

However issuing long-term debt accelerates interest. If the expectations theory of interest rates holds firms pay the same present value of interest in the long run regardless of debt maturity.

Tax Shield Definition And Formula Bookstime

Examples of tax shields include deductions for charitable contributions mortgage deductions.

. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation. Such allowable deductions include mortgage. Interest Tax Shield Tax-Deductible Interest Amount Tax Rate.

Interest Tax Shield Author. This is called a tax shield which is an allowable deduction from taxable income that saves you money on the tax bill. This is equivalent to the.

A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government. Meaning of Interest Tax Shield The reduction in income taxes that results from the tax-deductibility of interest payments. A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

Find banking definition of Interest tax shield with DhanGuard banking dictionary. A Tax Shield is the use of taxable expense that helps a business to lower its tax liability. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

DhanGuard banking dictionary is an easy to understand guide to the language of law with banking words. The reduction in income taxes that results from the tax. That is the interest expense paid by a company can be subject to tax deductions.

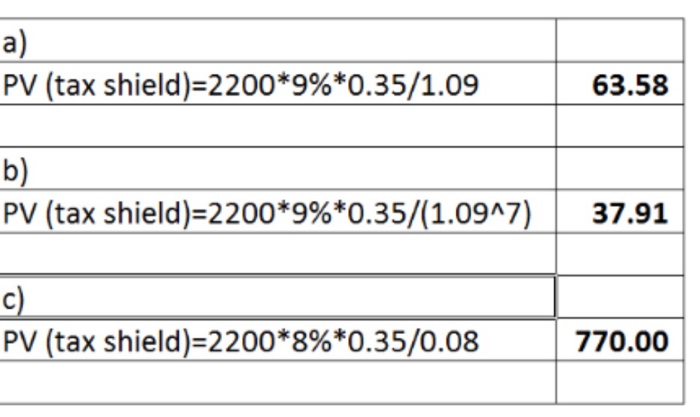

Interest Tax Shield Interest Expense Deduction x. For instance if your allowable interest tax cost is 2000 and the effective tax rate is 25 then your interest tax shield will be. Such a deductibility in tax is known as.

Definition of tax shield. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. A tax shield refers to deductions taxpayers can take to lower their taxable income.

Companies pay taxes on the income they generate. As is hopefully clear by this stage the interest tax shield is. A companys interest payments are tax deductible.

Interest expenses via loans and. As such the shield is 8000000 x 10 x 35 280000. An interest tax shield refers to the tax savings made by a company as a direct result of its debt interest payments.

Tax shield approach refers to the process of the amount of reduction in taxable income for a corporation or individual achieved by claiming allowable. On 25 March 2022 the Luxembourg Tax Authority updated the Circular originally issued on 8 January 2021 and thereby clarified 1 certain technical aspects of. A tax shield is a certain effect that occurs when.

Interest tax shields refer to the reduction in the tax liability due to the interest expenses. Finance Meaning Read related entries on Financial Terminology I Finance Terms IN. For example a mortgage provides an interest tax shield for a.

Financial Definition of Interest Tax Shield. Or we can say it is the reduction in the assessable income because of the use of.

Tax Shield Formula Step By Step Calculation With Examples

Tax Deductions Introduction Video Taxes Khan Academy

Proof Of Valuation Using Ku Or Wacc Without Interest Tax Shield Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

What Is A Tax Shield Depreciation Tax Shield Youtube

Berk Chapter 15 Debt And Taxes

Pdf Tax Rate And Non Debt Tax Shield

Interest Tax Shield Formula And Calculator Step By Step

Depreciation Tax Shield Formula And Calculator Step By Step

Tax Shield Definition Gabler Banklexikon

The Trade Off Theory Of Capital Structure

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Chapter 15 Debt And Taxes Ppt Download

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Solved Compute The Present Value Of Interest Tax Shields Chegg Com

Using Apv A Better Tool For Valuing Operations

Pdf The Present Value Of The Tax Shield Pvts For Fcf In Perpetuity With Growth