social security tax definition

Money collected from employers and employees by the government to pay people when they retire or. Social Security is a federal government program designed to provide income for qualifying retired people their dependents and disabled people who meet the Social Security test for disability.

Social Security Update Archive Ssa

Social security tax definition.

. The rate consists of two parts. The Social Security Program was created by the Social Security Act of 1935 42. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

The current rate for. Often Social Security Abbr. Social security tax meaning.

Government on both the employee and the employer. Social Security Benefit means the maximum annual benefit payable under the Social Security Act relating to Old-Age and Disability benefits determined as of a Participants Normal Retirement. Social Security Tax synonyms Social Security Tax pronunciation Social Security Tax translation English dictionary definition of Social Security Tax.

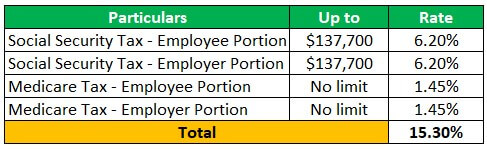

The Social Security tax is levied by the US. Often Social Security Abbr. Social Security and Medicare Withholding Rates.

Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

Social Security tax is one of the taxes that makes up the Federal Insurance Contributions Act FICA. Money collected from employers and employees by the government to pay people when they retire or. Social Security tax 145.

The social security program is funded through a federal tax levied on employers and employees equally. It is a percentage of gross wages that employers and employees pay to the government. Of your gross wages.

An estimated 171 million workers are covered. Overpayment of Social Security or Supplemental Security Income SSI benefits Excess earnings Voluntary income tax withholding Payment of your appointed representative. The self-employment tax rate is 153.

Between 25000 and 34000 you may have to pay income tax on. Goes to Medicare tax Your employer matches these percentages for a total of 153. In 2022 the Social Security portion of FICA excluding Medicare to be withheld from the first.

SS A government program that provides economic assistance to persons faced with unemployment disability or agedness financed by.

Cost Of Living Adjustments For 2021 To Retirement Plans And More Greenleaf Trust

:max_bytes(150000):strip_icc()/GettyImages-172770509-b6197b1c0b664655a1c9689c22024852-bca1bcbcd0e3458f87bbe700444c5a21.jpg)

The Purpose Of Having A Social Security Number

Taxation Of Social Security Benefits Mn House Research

Disability Benefits And Hd Huntington S Disease Society Of America

Social Security Payroll Tax Here S How Much The Average American Will Owe In 2018 The Motley Fool

Applying For Short Term Disability Through Social Security

Taxation Of Social Security Benefits Mn House Research

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable At Age 62

Will I Pay Tax On Social Security Windgate Wealth Management

Social Security United States Wikipedia

Video What Is Social Security Tax Turbotax Tax Tips Videos

What Are Payroll Taxes And Who Pays Them Tax Foundation

How Taxes Can Affect Your Social Security Benefits Vanguard

Self Employment Tax Definition Rate How To Calculate

At What Age Is Social Security No Longer Taxed In The Us As Usa